We bring your most majestic visions to life.

We specialize in solutions that bring results to your business. Contact us for a free consultation.

We leverage our extensive design and technology expertise to create leading brands and exceptional digital experiences.

Branding

We connect brand and UX, creating consistent digital identities across channels with strategic guidance to ensure seamless and cohesive brand representation.

Digital solutions

We create memorable enterprise and consumer products, ensuring exceptional user experiences and providing comprehensive design systems for easy iteration.

Paid Media

We craft impactful advertising campaigns, ensuring exceptional reach and engagement, and providing comprehensive strategies for seamless execution.

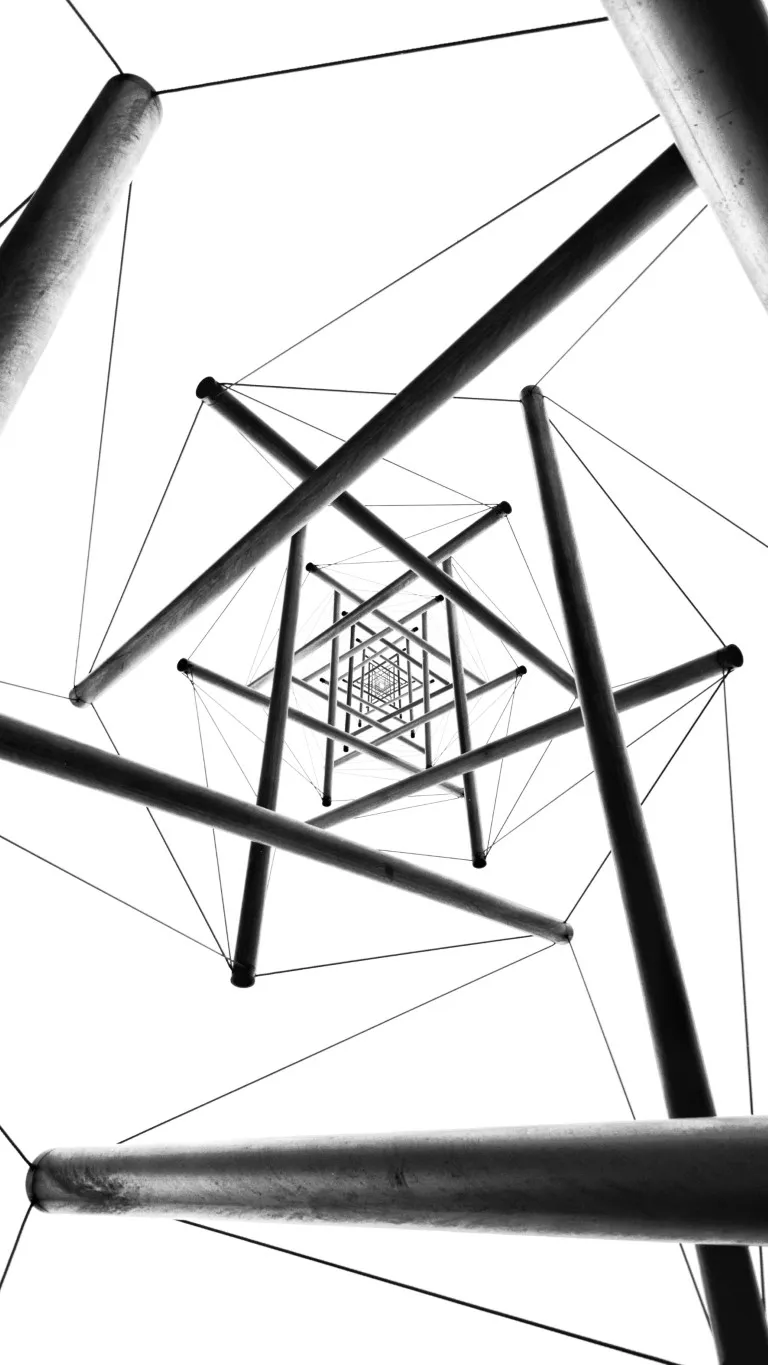

Recent Works

QuantumFlow Dynamics

Quantum Computing, Fluid Dynamics, High-Performance Computing, Process Optimization

VortexTech Dynamics

Quantum Computing, Fluid Dynamics, Aerospace, Maritime Engineering

NexaCore Systems

Industrial IoT, Automation, Machine Learning, Manufacturing

SkywardTech Solutions

Enterprise, UX/UI, Digital Transformation